Economists have come out to applaud the suggested move by the Deputy Prime Minister and Minister of Finance Pichai Chunhavajira, in which the minister came out to suggest that Thailand should follow the 15-15-15 formula for the corporate-income and Value added Taxes (VAT).

Although the proposal to possibly raise the Value Added Taxes (VAT) was shot down by the Prime Minister Paetongtarn Shinawatra on Friday, the proposal to raise the VAT has been an issue that most governments have had to differ despite the need to undertake the move sooner or later.

The backtracking of the plans came after social media backlash that prompted the public to misunderstand the true concept. Pheu Thai party even has come out with a campaign poster to tell people to stop manipulating news content that the government wants to raise VAT.

Thailand’s tax base remains low with reportedly only 20 out of the 67 million people registered to the tax system and far lower numbers paying the income taxes. Some estimates put the tax paying population at a mere 4 million Thais.

Personal income taxes in Thailand are paid on a progressive rate with a maximum of 35% of the income received and a lowering of rates to 15% would make Thailand among the lowest personal income tax level in the entire Asia pacific region.

The only other area that could be of comparison is the oil rich United Arab Emirates where there are no personal income taxes.

The move to undertake a ‘study’ of the reduction of the income taxes while at the same time helping lower the corporate income tax to 15% from 20% currently are things that could help attract more investments and increase the tax paying base.

Kiatnakin Phatra Securities came out with a report that discusses a potential tax reform proposal in Thailand, known as the “15-15-15” framework, which suggests setting the VAT, personal income tax, and corporate income tax at 15%.

“In the context of the global minimum tax rate of 15%, Thailand’s corporate income rate of 20% may be reconsidered to enhance competitiveness. Adjusting personal income tax rates could attract global talents. Aligning with international trends of lowering personal income tax rates may make Thailand more competitive in the global market,” Pipat Luengnaruemitchai, emerging Asia economist at Phatra said in a note to clients.

VAT the Political Minefield

VAT has been a political minefield ever since it was proposed in 1992, and it was only implemented because of the economic crisis of 1997. The Tom Yum Krung crisis which started with the floating of the Thai Baht on July 2, 1997, triggered the implementation of the 7% VAT although initially it was set at 10%.

Over the nearly 30-years VAT has remained at 7% and every time a government wants to raise the VAT, a public backlash kills the plans.

This time the plan by FinMin Pichai took the entire plan to a new level, pushing the VAT to as high as 15%, a statement that triggered a backlash to a point that Prime Minister Paetongtarn had to come out to deny there were such plans.

Pipat along with every other economist say that the current rate of VAT of 7% in Thailand is below the global average of 15-25%, therefore leaving the country with some degree of possible adjustments in the near future.

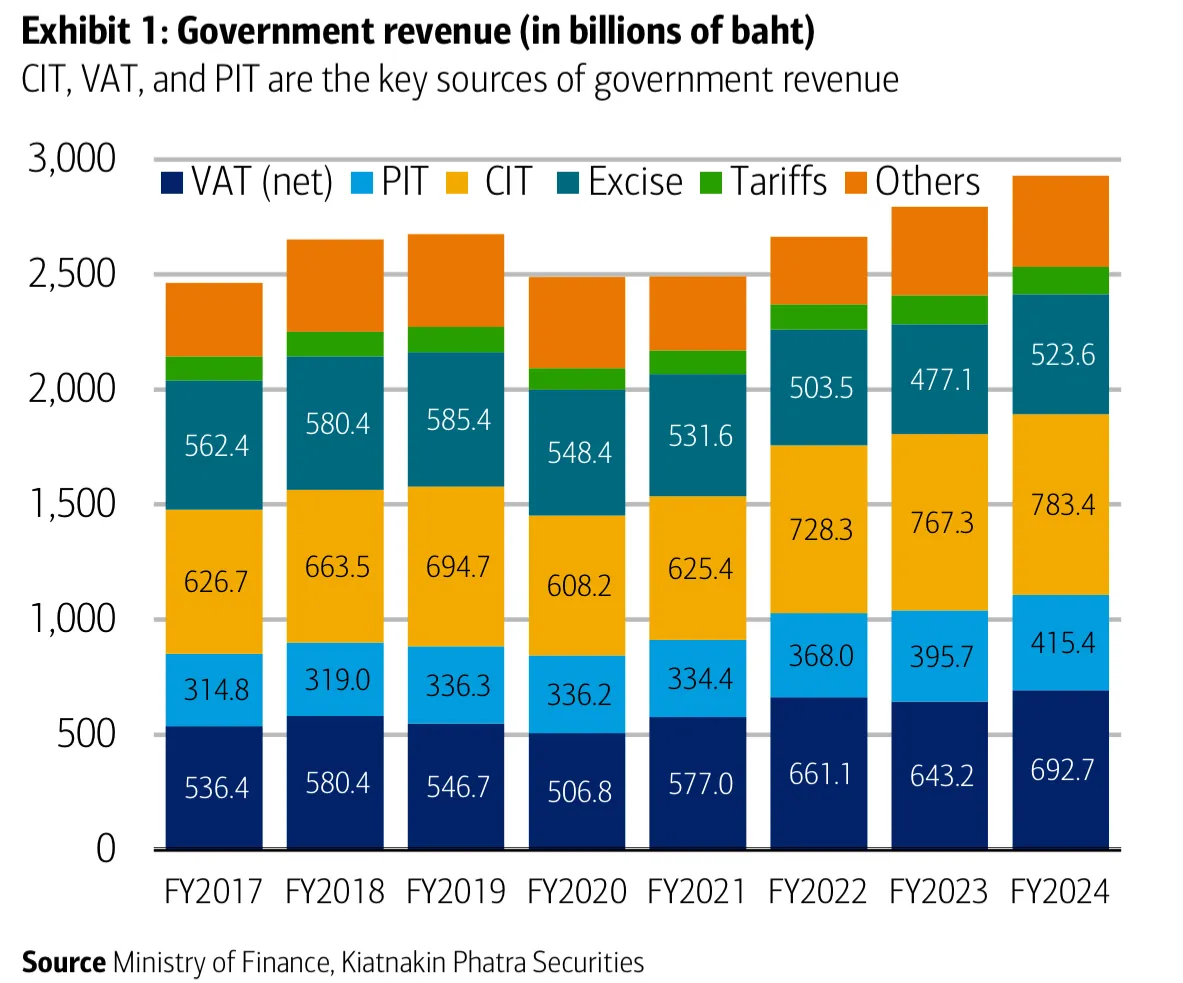

Economists say that the government needs to boost tax revenue due to a lower tax base, higher structural deficits, and rising public debt. Reducing corporate income taxes from 20% to 15% would cost about 193 billion Baht, which could be offset by increasing VAT from 7% to 10%, potentially raising 286.2 billion Baht.

Pipat says that his expectations are that a more likely scenario is a VAT increase to 8%, with rebates for low-income groups to mitigate negative impacts.

Phatra’s report also references Japan’s experience with sales tax increases, noting that consumption typically accelerates before a tax hike and falls sharply afterward, with a more pronounced impact on durable goods.

Overall, the report highlights the need for ambitious tax reforms in Thailand to address fiscal challenges while considering the economic and political implications of such changes.

Impact on the Tax Reforms

Dan Fineman, strategist at Phatra issued another report in which he discusses the potential implications of proposed tax reforms in Thailand, focusing on a corporate income tax cut from 20% to 15% and a VAT increase from 7%. Key points include:

- Tax Reform Proposal: The Thai government is considering reducing the corporate income tax rate to 15%, offset by an increase in VAT, with personal income tax reforms also under consideration.

- Macro Implications: A VAT hike is expected to have the most significant macro impact, potentially accelerating consumption before implementation, followed by a temporary fall and then normalization at a lower level.

- Market Impact: A corporate tax cut would boost the earnings of covered stocks by 5% on average, with the market likely to reflect these gains in advance. Historical data from 2012-13 shows markets performed well initially but poorly later due to other economic factors.

- Sector Sensitivity: A VAT hike would most affect discretionary consumption, with sectors like CRC and home improvement being more sensitive than convenience stores and supermarkets.

- Stock and Sector Beneficiaries: Most sectors would see a 4-6% gain from the corporate tax cut, with exceptions like Tourism, Chemicals, and REITs. Construction Materials could see larger gains due to specific ongoing losses.

- Uncertain Prospects: Despite the analysis, the prospects for tax reform are uncertain due to opposition to the VAT hike.

- Corporate Governance and Anti-Corruption: The report includes disclosures on corporate governance and anti-corruption ratings of Thai listed companies, highlighting those with excellent, very good, and good scores.